Discover the Benefits of Joining soo co op credit union

Are you looking for a financial institution that offers personalized services and competitive rates? Look no further than soo co op credit union. This credit union is dedicated to providing its members with exceptional value and support. In this article, we will delve into the various aspects of soo co op credit union, including its history, services, and benefits. Get ready to explore the reasons why joining this credit union could be a game-changer for your financial well-being.

History and Background

Established in [Year], soo co op credit union has been serving the community for [Number] years. It started with a small group of individuals who wanted to create a financial institution that would prioritize the needs of its members over profit. Today, the credit union has grown to become a trusted partner for thousands of individuals and families in the area.

Services Offered

soo co op credit union offers a wide range of services to cater to the diverse financial needs of its members. Here are some of the key services you can expect:

-

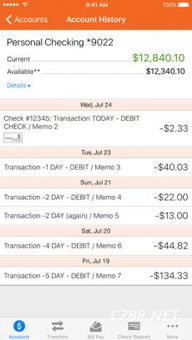

Checking and Savings Accounts: soo co op credit union provides various checking and savings account options, including free checking accounts with no minimum balance requirements.

-

Loans: From personal loans to auto loans, soo co op credit union offers competitive rates and flexible terms to help you achieve your financial goals.

-

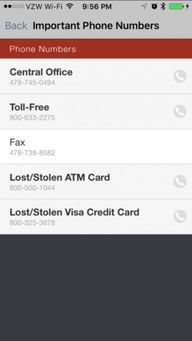

Debit and Credit Cards: The credit union offers Visa debit and credit cards with rewards programs and fraud protection.

-

Online and Mobile Banking: soo co op credit union provides convenient online and mobile banking services, allowing you to manage your finances on the go.

-

Investment and Retirement Services: The credit union offers investment and retirement planning services to help you secure your financial future.

Benefits of Joining

Joining soo co op credit union comes with numerous benefits that can enhance your financial experience. Here are some of the key advantages:

-

Competitive Rates: soo co op credit union offers competitive rates on loans, savings accounts, and certificates of deposit, helping you save money and grow your wealth.

-

Personalized Service: The credit union’s dedicated team of professionals is committed to providing you with personalized service and support. You can expect friendly and knowledgeable assistance whenever you need it.

-

Community Involvement: soo co op credit union is deeply rooted in the community and actively supports local initiatives and organizations. By joining, you become a part of this commitment to making a positive impact.

-

Member-Driven: As a member, you have a say in the credit union’s decisions and can vote on important matters. Your voice matters, and your opinions are valued.

Membership Requirements

Joining soo co op credit union is simple and straightforward. Here are the basic requirements to become a member:

-

Residency: You must live, work, or attend school in the credit union’s service area.

-

Minimum Deposit: To become a member, you need to make a minimum deposit of $5 into a savings account.

Conclusion

soo co op credit union is a financial institution that stands out for its commitment to its members and the community. With a wide range of services, competitive rates, and personalized support, it’s no wonder why so many individuals and families choose to join. By becoming a member, you can take advantage of the numerous benefits and make your financial journey a success. Don’t wait any longer 鈥?explore soo co op credit union and discover the difference it can make in your life.

| Service | Description |

|---|---|

| Checking and Savings Accounts | Various checking and savings account options, including free checking accounts with no minimum balance requirements. |

| Loans | Competitive rates and flexible terms on personal, auto, and other types of loans. |

| Debit and Credit Cards | Visa debit and credit cards with rewards programs and fraud

|